Home Buyer’s Plan is a program from the Canadian government to help first-time home buyers finance their purchases.

The Home Buyers’ Plan allows first-time home buyers to withdraw up to $35,000 from their Registered Retirement Savings Plan (RRSP) tax-free, as long as the funds are used to purchase a home. Unlike a traditional RRSP withdrawal, where you’re taxed on the withdrawal amount, the HBP allows you to defer the tax liability until a later date.

But what happens when you withdraw from an RRSP? The amount is considered taxable income, and you’ll be charged accordingly. However, with the Home Buyers’ Plan, you can use the money to buy your first home and repay it over time, without having to pay it back all at once.

Repayment to your RRSP starts two years after the withdrawal date, but the full HBP repayment schedule must be completed within 15 years.

How does home buyers plan work (RRSP is the key)

In the home buyers plan, if you have an RRSP, you can withdraw up to $35,000 to use for a down payment. You can also withdraw money from your common-law partner’s or spouse’s RRSP. If you both intend to buy your first home together, that’s a combined $70,000 that you can use as a down payment.

It’s important to note that not everyone is eligible for the Home Buyers’ Plan. You must be a first-time home buyer and have a written agreement to buy or build the qualifying home. The home must also be your primary residence, and you must intend to live in it within a year. There are also other eligibility conditions to consider, so it’s essential to do your research beforehand.

Benefits of Home Buyers Plan

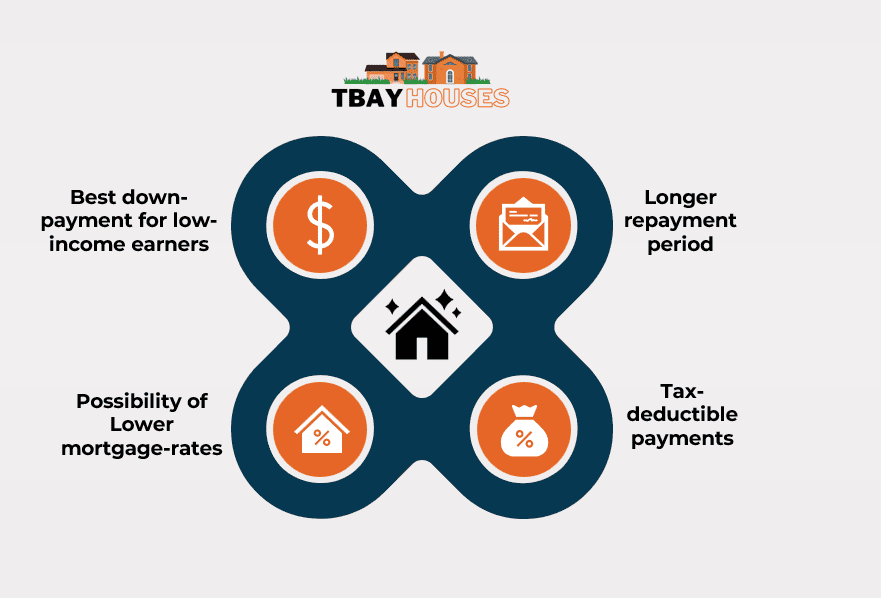

Perhaps the biggest benefit of the Home Buyers Plan is that it offers a new source of funds for a down payment, which can be especially helpful for those who have been struggling to save up the necessary funds. Additionally, the 15-year repayment period for the withdrawn amount gives users a bit more breathing room than traditional loans or lines of credit, making it a more manageable payment plan.

Another potential benefit of using the HBP is that some lenders may offer lower mortgage rates to those who use the program. This is because having a larger down payment can make a borrower less of a risk for a lender. Additionally, mortgage payments made with funds withdrawn from an RRSP through the HBP may be tax-deductible, which provides another advantage to using this program.

Ultimately, the Home Buyers Plan can be a valuable tool for first-time home buyers looking to make a more manageable down payment and repay it over a longer period of time. Additionally, the program may offer some additional financial benefits, such as the potential for lower mortgage rates and tax deductions.

How to repay home buyers plan

If you’ve taken advantage of the Home Buyers Plan (HBP) to withdraw money from your registered retirement savings plan (RRSP) to buy your first home, it’s important to understand how to repay the amount you’ve borrowed. By following the instructions provided by the Canada Revenue Agency (CRA), you can make sure you comply with the repayment timeline and avoid additional taxes.

Repayment for Home Buyers’ Plan withdrawals must be made within a 15-year period starting two years after the withdrawal. The CRA will send you a statement of account each year, indicating any payments made, the remaining HBP balance, and the minimum payment for the following year. This statement will help you keep track of your payments and ensure you’re on track to meet the repayment deadline.

Your yearly payment is determined by dividing the full withdrawal amount by 15. For example, if you withdrew $30,000, your yearly payment would be $2,000. You can make contributions towards repayment to your RRSP in the year of repayment or within 60 days in the following tax year. Be sure to designate these contributions as a repayment using Schedule 7 and lines 24500 and 24600.

In case you missed a payment, the missed amount will be added to line 12900 of your income tax return as an RRSP income. It’s important to make these repayments on time to avoid any additional fees or taxes.

By following these instructions and understanding the repayment timeline, yearly payment, RRSP contribution, CRA statement, and repayment designation, you can successfully repay your Home Buyers Plan and benefit from returns in the future.

What are the drawbacks of home buyers plan?

One of the most significant drawbacks of the HBP is the repayment schedule. Once you withdraw funds from your RRSP under the HBP, you’re required to repay the amount annually for a period of 15 years. If you fail to make a repayment in any given year, the amount is added to your taxable income, which can result in additional taxes and possibly even a tax audit.

Another potential downside of the HBP is the impact it may have on retirement savings. By allocating funds from your RRSP to the HBP, you may be reducing the amount of money you’re saving for your retirement. This could result in a future financial shortfall as you near retirement age.

Additionally, there’s a chance that you may not be able to sell your primary residence and repay the HBP balance due to unforeseen market conditions or other circumstances beyond your control. This could leave you with a significant debt that still needs to be repaid.

While the HBP can certainly be a benefit to first-time home buyers, it’s important to be aware of these potential drawbacks in order to make the most informed decision for your financial future. By understanding the repayment schedule, impact on retirement savings, and potential difficulties in selling your home, you can better navigate the HBP and avoid any unexpected financial challenges down the road.

Who can qualify for the HBP?

To qualify for the home buyer plan, you must be a Canadian resident and a first-time home buyer. If you’ve never owned a home before, or you meet the special rule for people who have a disability, you’re considered a first-time home buyer. This means you don’t have to repay any previous HBP withdrawals on your tax return.

To use the HBP, you must buy or build a qualifying home, which must be your principal residence within one year of its purchase or completion. If you’re buying a home with a common-law partner, each of you can use the HBP if you meet the eligibility conditions.

It’s important to note that you can only use your own contributions to withdraw from RRSPs under the HBP. If you have locked-in or group RRSPs, you may not be able to use them to withdraw funds.

Additionally, you must make all RRSP withdrawals in the same tax year, and you must start making minimum payments on your withdrawal in the second year after the year you withdrew the funds.

If you’ve participated in the HBP in the past, you must wait for four years before participating in the plan again.

In summary, if you’re a first-time home buyer who meets the eligibility conditions and is buying or building a qualifying home, you may be able to use the HBP to make your home purchase more affordable. Just keep in mind the limitations on using locked-in or group RRSPs and the four-year waiting period between HBP participation.