Do you want to invest in real estate but don’t know what trends to pay attention to?

Real estate is a great way to make some extra money, but it can be tricky to stay on top of industry trends.

This article will review the major real estate trends of 2023 so that you can make an informed investment decision. I’ll review everything from property sales, and demand for rentals to popular home styles

What experts are saying about the 2023 housing market?

The housing market in 2023 is anticipated to undergo some major changes. Most experts believe that after a few years of a tailspin, this is the year when things will really take off.

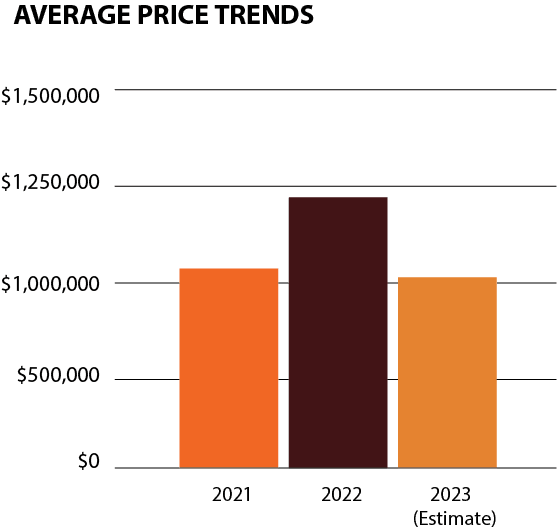

Though the first half of the year may still be rough due to high borrowing costs and economic instability, experts anticipate that demand for ownership housing will rise in the second half as mortgage rates remain relatively low, supported by a resilient labor market and record immigration levels. As such, average selling prices will bounce back to $1,140,000 across all home types; however, overall average prices for 2023 across the board are still expected to remain four percent lower than 2022 averages.

Experts agree that using conservative investing strategies is key to successfully navigate these complex waters in 2023. Investors should be well-prepared before taking any big risks and opting into far-reaching decisions with their investments. It’s also important to anticipate shifts in the market as they come and understand how different aspects affect expectations of what type of returns can be expected going forward.

By doing so investors can avoid mistakes like buying too high or selling too low which could cost them thousands in profits down the road if not monitored properly. The investment trends expected throughout 2023 should provide plenty of opportunities — it just comes down to making informed decisions on when (and where) to jump on board!

What should first-time home buyers do in 2023?

If you’re looking for a starter home in 2023, it’s important to do your research and know what you should be looking for. With a starter family, condo townhouses may be the best option for first-time home buyers.

The major difference between a condominium townhouse and a freehold townhouse is that with a condominium townhouse, the buyer has to buy the units as well as agree to share common areas such as swimming pools, clubhouses, and other amenities with owners of other condos. Condo towns also have shared insurance policies so that risk is spread over all buyers. On the other hand, freehold townhomes are owned exclusively by one owner who may modify or upgrade amenities as they see fit.

With prices continuing to rise in Toronto, it’s likely that condo towns will play a bigger role than ever before when it comes to home buying in 2023. It’s also important to keep an eye on interest rates – if they’re low, then that may make financing a bit easier when picking out a new place. Shopping around from different lenders can also net you some great deals on mortgage rates if you take the time to compare them.

Finally, taking advantage of government incentives for first-time homeowners can really help reduce overall costs when diving into homeownership.

In summary, if you’re looking to become a first-time homeowner in 2023 then considering condo townhouses is important due to their affordability and shared amenities with other tenants. Be sure to research current interest rates and see what types of incentives are available from your local or federal governments so you can get the best deal possible!

What should home sellers do in 2023?

The single most important thing they must do is accurately price their home. In 2023, agents cannot just post a listing in the MLS and wait for offers to come rolling in as they could in previous markets. The task of pricing your home accurately has become even more important because it can determine how easily the property sells and at what price it ultimately sells. Additionally, an overpriced home may take longer to sell and be noted by buyers, appraisers, and underwriters – not a good sign.

Therefore, it’s imperative that sellers work with experienced agents who can review the data and provide accurate pricing which can then adjust as necessary to any changing conditions in the market. Accurate pricing is one of many aspects sellers should consider when marketing their homes for sale. They should also make sure the property appeals to its target buyer demographic, is in its best condition possible, and is being marketed where prospective buyers are likely to interact with it (professional photos, eye-catching narrative captions).

In short, there are a few key things you should focus on if you’re planning on selling a house in 2023: hire experienced agents; use accurate data to properly price their house; ensure it has strong curb appeal; promote where potential buyers can find it. Following these steps will boost your chances of a successful sale!

How is the rental market in 2023?

The data released by Stats Can shows that the rental market in 2023 is facing some serious complications. With investors now comprising the largest cohort of buyers in Canada’s real estate market, they are buying more and more condos, driving up prices and making it difficult for first-time home buyers to purchase their own homes. As a result, more and more people are stuck renting. Additionally, investors are taking advantage of Airbnbs or flipping units which further reduces the available long-term rental supply.

To combat this situation, taxation policies must be established that make landlords less attractive and instead provide incentives for those buying homes to live in them, in order to restore the natural transition from renting to owning.

Can foreign investors buy real estate in Ontario, Canada in 2023?

The short answer to this question is no- foreign investors will not be able to buy residential real estate in Canada beginning January 1, 2023. This is due to the Prohibition on the Purchase of Residential Property by Non-Canadians Act, which was passed and enacted earlier this year as part of the federal government’s Budget Implementation Act for 2022.

This act prohibits anyone but Canadian citizens or permanent residents from buying residential real estate for two years in order to create a framework that better regulates foreign buyers in our housing market and ensures housing is available for Canadians only. The Liberal Party promised this legislation during their 2021 election platform, citing their main goal as “making the market fairer for Canadians” and preventing foreign buyers from taking advantage of our markets.

Ultimately, all non-Canadian investors must wait until at least 2025 before they can start buying into Canada’s real estate markets again.

What are the current popular house styles in 2023?

The house styles that are currently popular for 2023 can vary from region to region. However, some of the most prominent trends in the market include contemporary touches and traditional designs. For example, updated craftsman-style homes and modern farmhouses are among the more sought-after styles in many regions.

Inside these houses, many popular features include open floor plans, functional kitchens with high-end appliances, large master suites with abundant closet space, and in-ground pools as well as outdoor living spaces. Many homeowners are changing up the interior style to reflect their preferences while still maintaining a central theme throughout the home.

The exterior facades on many of these homes feature neutral colors with bold accents around windows and doors as well as under overhangs. Designers have been incorporating natural elements like wooden accents and stone detailing for visual interest when it comes to curb appeal.

Finally, eco-friendly materials like metal roofing are quickly gaining popularity due to their sustainability benefits and cost-effectiveness in protecting homes against extreme weather conditions.

What happens to real estate during a recession? | Real estate recession 2023

When a recession hits, the effects on the real estate market are profound and far-reaching. While prices may depreciate and rental payments become higher than incomes, it can be difficult to determine what will happen to the value of different types of real estate. In general, however, we can expect certain trends to emerge during a recession.

For one, investors will likely move their money into growing regions in order to get the best return possible on their investments. This is because these locations tend to offer lower home prices and greater potential for profit when the economy recovers from its downturn. In addition, we can expect a surge in demand for rental homes during a recession as many people opt for more cost-effective housing options due to income fluxes. On the other hand, landlords may have reservations about granting leases in light of rapidly increasing interest rates on loans and mortgages.

Overall, recessions are known to bring extreme uncertainty which often has complicated ramifications that influence various aspects of the real estate market. As such, investors should take special care when it comes to protecting their investments during economic downturns.